Since the early days of the internet, ecommerce has directly competed with physical stores for consumer spending. For many, the 2020 pandemic and resulting boom in online sales marked the end of in-person shopping for good, but the truth is a little more nuanced.

To paint a clearer picture of the future of ecommerce, we surveyed over 8,000 consumers and 400 retail business executives. We compiled our findings into the Ecommerce Delivery Benchmark Report 2025, outlining how businesses adapt to new realities and the effects of new technologies, like AI, on growth strategies.

Here’s what we found.

An Upcoming Inflection Point

After years of rapid growth in North America and Europe, the ecommerce market has matured, reaching a peak. Of the businesses we surveyed, 84% reported growth in 2024, but only an average of 5.6% industry-wide, a far cry compared to a few years ago.

A Post-COVID Commerce Market

Consumer data further justifies the poor performance, as more than half of individuals surveyed said they plan on shopping more in-store in 2025. More than bargains or convenience, younger generations (primarily Gen Z and millennials) prioritise immersive and satisfactory shopping experiences, whether online or offline.

Rather than wage a battle between in-person and online shopping, the future of commerce is in prioritising omnichannel marketing. It’s time to master the complexity of integrating the digital with the physical instead of choosing one over the other, especially if you can’t fight against the low prices of online retail giants like Temu or Shein.

Solving the Delivery Problem

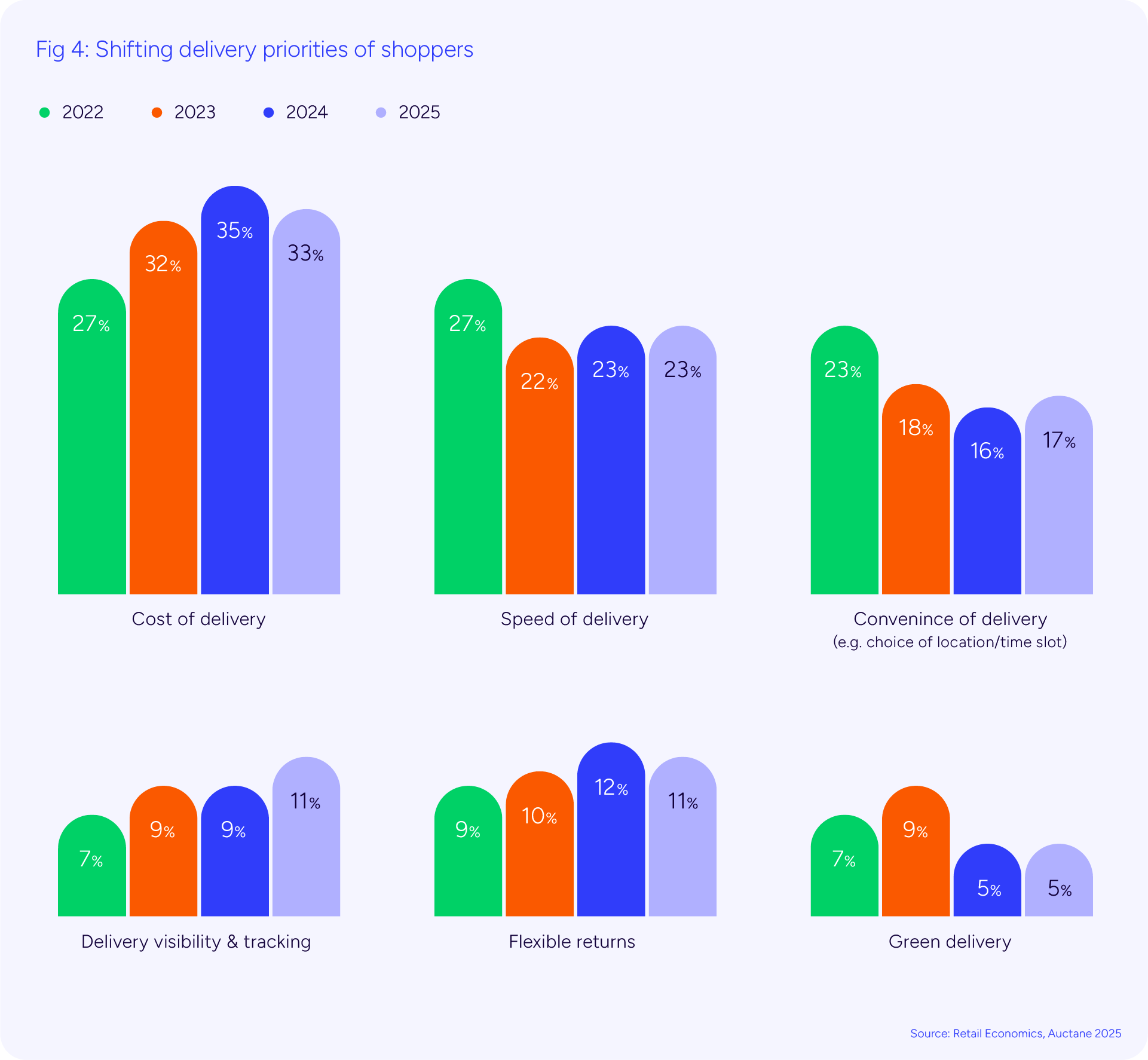

The time between a customer placing an order and receiving their package has the potential to either make or break a loyal customer. While customers overwhelmingly prioritise affordable delivery and speed, you can’t neglect factors such as convenience and trackability.

What’s Driving Ecommerce Growth in 2025?

It’s no secret that ecommerce first took off thanks to the widespread adoption of the internet, and then once again with smartphones and social media. Nowadays, retailers need to track generative AI and growing overseas markets carefully.

Making the Most of Tech

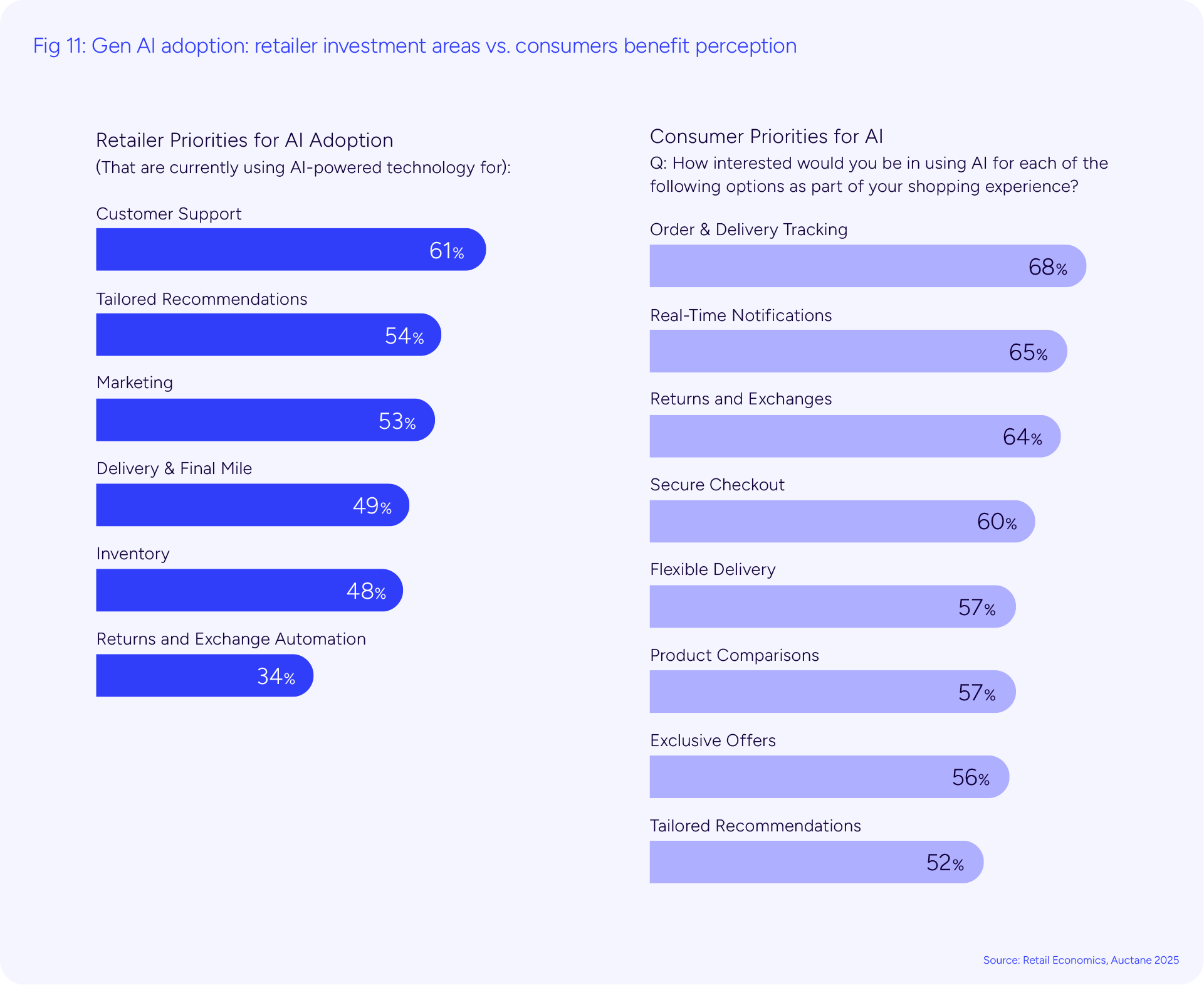

Customers view AI differently from executives and administrators. They generally prioritise technology that tracks their orders and provides real-time, custom notifications. Meanwhile, retailers are focusing AI more on automated chatbots and smart FAQ pages. Our 2025 Benchmark report found that consumers are most interested in using AI for order and delivery tracking, while retailers currently prioritise this technology for customer support.

Gen Z and Millennials Hold the Shopping Control

Another critical growth aspect is generational interests. Millennials and Gen Z make up over 70% of all online shoppers, with more than half preferring content-based marketplaces over traditional ecommerce sites.

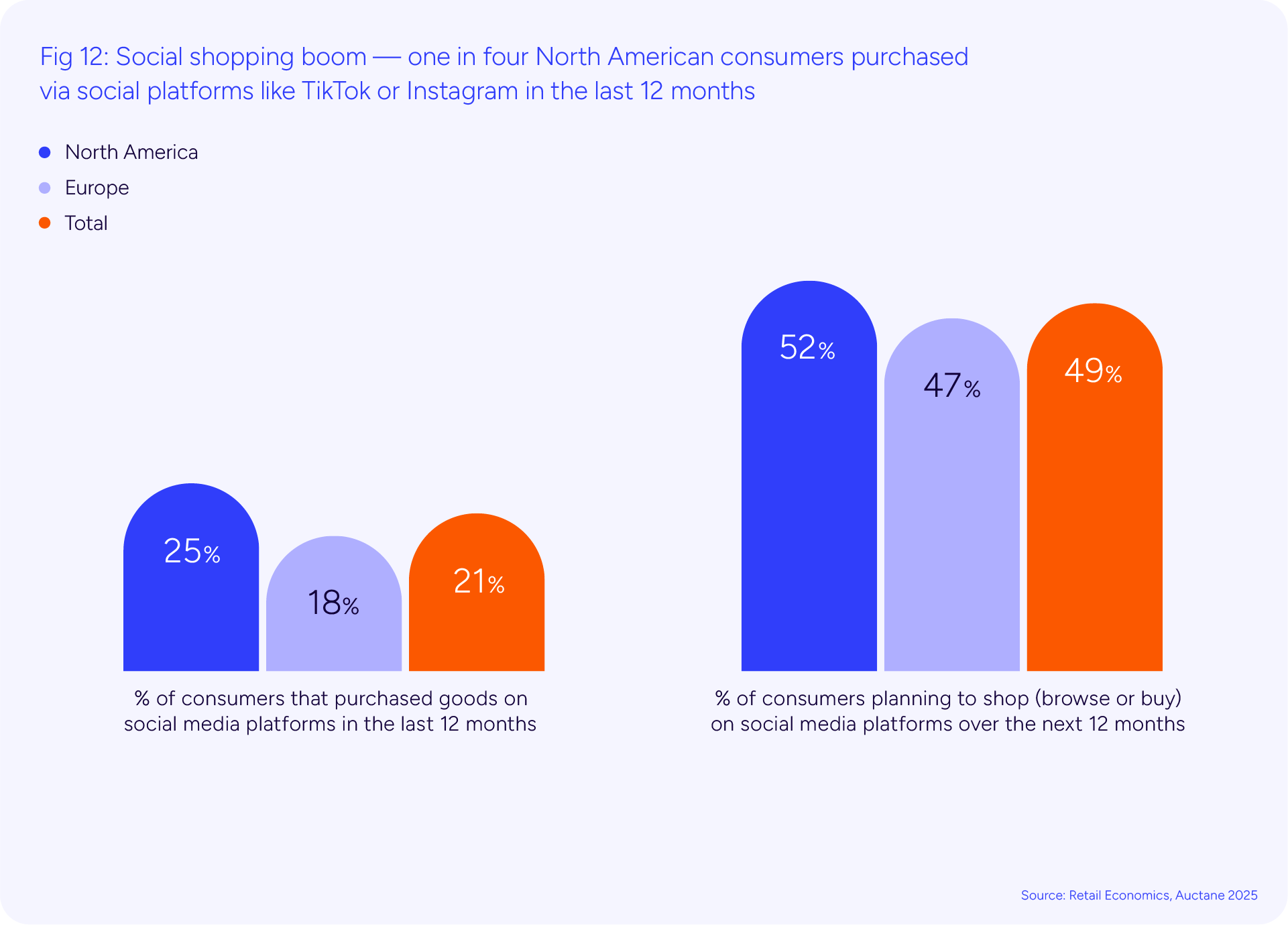

TikTok and Instagram have seen massive success in combining leisure web browsing with ecommerce. In North America, one in four consumers has purchased something off a social media market in the past 12 months.

Learning From Early Adopters

Another way retailers are bridging the gap between in-person and online shopping is through click-and-collect and in-store returns of items purchased online. Previously strictly brick-and-mortar stores like Walmart, Next, and Kingfisher (B&Q) were some of the first to successfully transition to this hybrid model.

Taping Into International Markets

The future of retail growth lies in international markets. Social media brings local eyes to your marketplace, but overseas interest, mainly in Southeast Asia, the Middle East, and Latin America, can help it take off. The trick is to start small, building relationships with international logistics and shipping companies, then scale fast, riding on the momentum of novelty and trends.

International expansion is looking particularly bright for apparel, luxury, and tech retailers. Consumers are willing to pay more for the quality and convenience of a product, leaving value-focused retailers to struggle.

Strategise or Miss Your Shot!

With a maturing market, rising operational costs, and heightened consumer expectations, it’s more important than ever to have a fool-proof strategy for growth moving forward. The path ahead will be paved with innovation and creativity, traits appreciated more by the younger generations compared to their older counterparts.

In our 2025 Benchmark Report, we gathered 10 actionable strategies to help you make the most of the 2025 ecommerce market:

- Take a unified approach to delivery and logistics

- Tailor the shopping experience to every individual consumer

- Global expansion is key for sustained growth

- Third-party service providers, vendors, and marketplace operators are your friends

- Focus on micro-fulfillment through omnichannel optimisation

- Plan for product returns and exchanges

- Make the most out of predictive analytics, AI, and inventory management

- Integrate with existing online marketplaces

- Merge discovery with sales through social commerce

- Foster customer loyalty with post-purchase engagement

Take full advantage of the upcoming retail revolution by being open to transforming and adapting to new environments. Explore our data-driven insights by reading the full Ecommerce Delivery Benchmark Report 2025.

When you’re ready, book a free demo with our delivery software experts to make your next move.